To set up QuickBooks for a small business, create a new company file. Then, enter your business details and configure settings.

QuickBooks is a powerful tool for small businesses. It helps manage finances efficiently. Setting it up correctly saves time and avoids errors. First, gather your business information. This includes your company name, address, and tax ID. Next, create a new company file in QuickBooks.

Follow the setup wizard prompts. Enter your business details accurately. Customize settings to suit your needs. Set up your chart of accounts. This organizes your financial data. Connect your bank accounts. This makes tracking transactions easier. QuickBooks will streamline your accounting process. It ensures accurate records and simplifies your financial management.

Introduction To Quickbooks

QuickBooks is a popular accounting software designed for small businesses. It helps manage finances, track expenses, and generate reports easily. Setting up QuickBooks can streamline your business operations and save time.

Benefits For Small Businesses

QuickBooks offers numerous benefits for small businesses:

- Time-saving: Automate financial tasks and reduce manual work.

- Accurate tracking: Keep precise records of income and expenses.

- Tax readiness: Simplify tax preparation with organized data.

- Cash flow management: Monitor cash flow in real-time.

- Invoicing: Create and send professional invoices quickly.

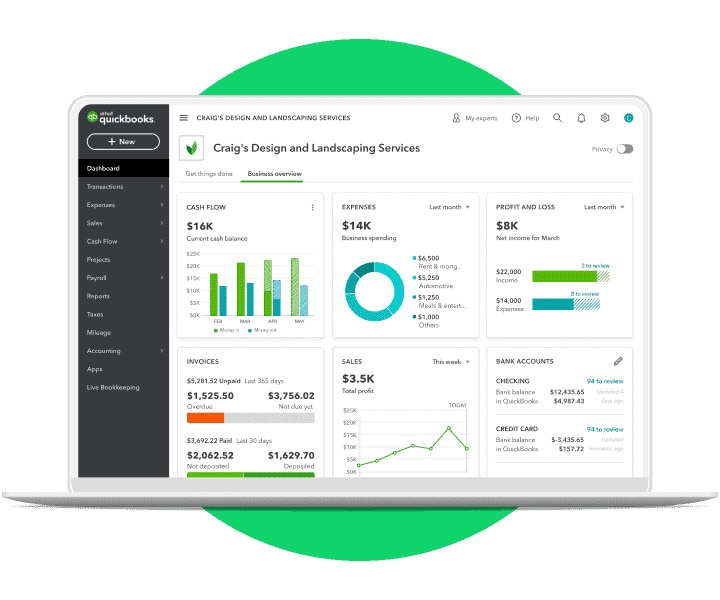

Key Features

QuickBooks is packed with features tailored for small businesses:

| Feature | Description |

|---|---|

| Invoicing | Create, customize, and send invoices easily. |

| Expense Tracking | Track expenses and categorize them. |

| Bank Reconciliation | Reconcile bank transactions with ease. |

| Reporting | Generate financial reports for insights. |

| Payroll Management | Manage payroll and employee payments. |

| Inventory Management | Track and manage inventory levels. |

These features help small businesses manage their finances efficiently. QuickBooks makes financial management simple and straightforward.

Credit: www.hostdocket.com

Choosing The Right Quickbooks Version

Setting up QuickBooks for your small business starts with choosing the right version. QuickBooks offers various versions tailored to meet different business needs. This guide will help you understand the differences between the versions and make an informed decision.

Online Vs Desktop

QuickBooks comes in two main formats: Online and Desktop. Each has its own features and benefits.

| Feature | QuickBooks Online | QuickBooks Desktop |

|---|---|---|

| Accessibility | Accessible from anywhere with internet | Installed on a local computer |

| Updates | Automatic updates | Manual updates |

| Backup | Cloud-based backup | Local backup required |

| Cost | Subscription-based | One-time purchase |

| Features | Basic to advanced, scalable | Advanced features, more comprehensive |

Pricing And Plans

QuickBooks offers several pricing plans to fit different business needs. Here is a breakdown of the most popular plans:

- QuickBooks Online Simple Start: Ideal for solo entrepreneurs. Costs around $25 per month.

- QuickBooks Online Essentials: Suitable for small businesses. Costs around $50 per month.

- QuickBooks Online Plus: Perfect for growing businesses. Costs around $80 per month.

- QuickBooks Desktop Pro: One-time purchase of about $299.95. Ideal for small to medium businesses.

- QuickBooks Desktop Premier: One-time purchase of about $499.95. Best for niche industries.

- QuickBooks Desktop Enterprise: Tailored for larger businesses. Pricing starts at $1,155 per year.

Each plan comes with a set of features that cater to different business needs. Compare the features and pricing to choose the best fit for your business.

Creating Your Quickbooks Account

Creating your QuickBooks account is the first step to managing your finances. This guide will help you set up your account efficiently. Follow these steps to get started:

Sign-up Process

Begin by visiting the QuickBooks website. Click on the Sign-Up button. You will be prompted to enter your email address and create a password. Make sure to choose a strong password to keep your account secure.

Once you have entered your information, click on Create Account. You will receive a confirmation email. Open the email and click on the verification link. This will activate your account.

| Step | Action |

|---|---|

| 1 | Visit QuickBooks website |

| 2 | Click on Sign-Up |

| 3 | Enter email and password |

| 4 | Click Create Account |

| 5 | Verify email |

Setting Up Company Profile

After your account is created, the next step is setting up your company profile. This is crucial for managing your business finances accurately. Follow these steps:

- Log in to your QuickBooks account.

- Navigate to the Company section.

- Click on Profile.

- Enter your company’s details, such as name, address, and industry.

- Save your information.

Your company profile is now set up. This information will be used across all QuickBooks features.

Tip: Keep your company information updated to ensure accurate record-keeping.

Credit: www.business.com

Customizing Company Settings

Setting up QuickBooks for your small business? You need to customize company settings. This ensures your QuickBooks setup fits your business needs. Let’s explore two key areas: Preferences and Options and User Permissions.

Preferences And Options

In QuickBooks, you can set various preferences. These preferences help tailor the software to your business needs.

To access preferences, follow these steps:

- Open QuickBooks.

- Go to the Edit menu.

- Select Preferences.

In the preferences window, you will find various tabs. Each tab represents different settings. Some key tabs include:

- Accounting: Set your fiscal year and other accounting preferences.

- Invoices: Customize your invoice templates and payment terms.

- Sales & Customers: Manage customer-related settings.

Adjust these settings based on your business requirements. Click OK to save your changes.

User Permissions

It’s crucial to manage user permissions. This ensures sensitive data is protected. QuickBooks allows you to set different access levels for users.

To manage user permissions:

- Go to the Company menu.

- Select Users.

- Choose Set Up Users and Roles.

In the user setup window, you can add new users. Assign each user a role. Each role has specific permissions.

| Role | Permissions |

|---|---|

| Admin | Full access to all features. |

| Sales | Access to sales and customer data. |

| Accountant | Access to accounting and financial reports. |

Customize each role according to your needs. Save the settings and ensure users understand their permissions.

Connecting Bank Accounts

Setting up your bank account in QuickBooks can save time. It helps track income and expenses efficiently. Here’s how to get started with connecting your bank accounts.

Linking Accounts

First, open QuickBooks and sign in to your account. Navigate to the Banking section on the left panel.

- Click Add Account.

- Search for your bank from the list.

- Enter your bank’s username and password.

- Follow the on-screen prompts to link your bank.

Once linked, your bank transactions will sync with QuickBooks. This keeps your financial records up to date.

Importing Transactions

After linking your accounts, import your past transactions. This ensures your financial history is complete in QuickBooks.

- Go to the Banking section.

- Select the bank account you linked.

- Click Update to sync recent transactions.

- To import older transactions, click Upload from file.

- Choose the file format supported by QuickBooks.

- Map the columns in your file to QuickBooks fields.

- Click Next and review the transactions.

- Click Finish to complete the import.

Imported transactions will now appear in your QuickBooks account. You can review and categorize them for accurate bookkeeping.

| Steps | Action |

|---|---|

| 1 | Open QuickBooks and navigate to Banking |

| 2 | Click Add Account and link your bank |

| 3 | Sync and import past transactions |

Connecting your bank accounts in QuickBooks enhances financial management. It streamlines your accounting tasks and provides real-time insights.

Setting Up Chart Of Accounts

Setting up the Chart of Accounts in QuickBooks is crucial for small businesses. It helps in organizing and tracking financial transactions. Let’s dive into the steps to set it up efficiently.

Default Accounts

QuickBooks provides a set of default accounts to get you started. These accounts cover basic financial needs. Below is a table showcasing some of these default accounts:

| Account Type | Account Name |

|---|---|

| Assets | Bank |

| Liabilities | Credit Card |

| Income | Sales |

| Expenses | Utilities |

You can use these default accounts for basic transactions. They are suitable for most small businesses. But you might need to customize your Chart of Accounts further.

Adding Custom Accounts

To tailor QuickBooks to your specific business needs, you may need to add custom accounts. Follow these simple steps:

- Go to the Chart of Accounts menu.

- Click on New to create a new account.

- Select the appropriate Account Type.

- Enter the Account Name and other details.

- Click Save and Close.

Here are some examples of custom accounts you might want to add:

- Marketing Expenses

- Consulting Income

- Office Supplies

- Equipment Purchase

By adding custom accounts, you can better track your specific expenses and income. This helps in generating accurate financial reports.

Managing Invoices And Payments

Efficiently managing invoices and payments is crucial for small businesses. QuickBooks offers robust tools to streamline these tasks. This ensures you get paid on time and maintain a healthy cash flow. In this section, we will explore how to create invoices and track payments using QuickBooks.

Creating Invoices

Creating invoices in QuickBooks is simple and intuitive. Follow these steps:

- Log in to your QuickBooks account.

- Navigate to the Sales menu on the left-hand side.

- Select Invoices.

- Click on the Create Invoice button.

- Fill in the necessary details such as customer name, date, and invoice number.

- Add the products or services provided.

- Review the total amount and apply any discounts if needed.

- Click Save and Send to email the invoice directly to your customer.

Creating professional invoices helps present a good image of your business. QuickBooks allows you to customize invoice templates to match your brand.

Tracking Payments

Tracking payments in QuickBooks is effortless and ensures you stay on top of your receivables. Here’s how to do it:

- Go to the Sales menu.

- Select Customers.

- Find the customer whose payment you want to track.

- Click on the customer’s name to view their transaction history.

- Locate the invoice and click Receive Payment.

- Enter the payment details, including date and amount received.

- Choose the payment method (e.g., bank transfer, credit card).

- Click Save and Close.

Tracking payments ensures you know who has paid and who hasn’t. QuickBooks provides detailed reports to monitor outstanding invoices and overdue accounts.

Managing invoices and payments in QuickBooks keeps your finances organized. This helps avoid cash flow problems and improves customer relationships.

Generating Financial Reports

Generating financial reports in QuickBooks helps you understand your small business’s financial health. These reports provide essential insights to make informed decisions. Here’s how to generate and customize financial reports in QuickBooks.

Essential Reports

QuickBooks offers several essential reports to track your business finances.

- Profit and Loss Report: Shows your income, expenses, and net profit.

- Balance Sheet: Displays your assets, liabilities, and equity.

- Cash Flow Statement: Tracks the money coming in and out.

Customizing Reports

QuickBooks allows you to customize reports to fit your business needs.

- Open the report you want to customize.

- Click on the Customize button.

- Select the data fields you want to include.

- Apply filters to narrow down the information.

- Save your custom report for future use.

Customizing reports helps you focus on the most important data.

| Feature | Benefit |

|---|---|

| Filters | Allows you to view specific data. |

| Fields | Lets you add or remove information. |

| Save | Retain your customized settings. |

These features make QuickBooks a powerful tool for financial reporting.

Integrating With Other Tools

Setting up QuickBooks for your small business can streamline your financial management. Integrating QuickBooks with other tools enhances its functionality. This allows you to automate tasks and improve efficiency.

Popular Integrations

QuickBooks offers many popular integrations with other tools. These integrations include:

- PayPal: Sync transactions and manage payments.

- Shopify: Connect your online store with QuickBooks.

- Square: Import sales data and simplify accounting.

- Stripe: Reconcile payments with ease.

- Gusto: Handle payroll and HR tasks efficiently.

These tools help you connect sales, payments, and payroll with QuickBooks. This integration saves time and reduces errors.

Benefits Of Integration

Integrating QuickBooks with other tools offers many benefits:

- Time-Saving: Automate data entry and reduce manual work.

- Accuracy: Minimize errors by syncing data automatically.

- Efficiency: Streamline your workflows and increase productivity.

- Real-Time Updates: Access up-to-date financial information.

- Comprehensive Reports: Generate detailed reports with integrated data.

Using these integrations, you can manage your business finances better. You can focus on growing your business while QuickBooks handles the rest.

Tips For Maintaining Quickbooks

Maintaining QuickBooks for your small business is crucial for accurate financial management. Here are some tips to ensure your QuickBooks remains efficient and error-free.

Regular Updates

Keeping your QuickBooks software updated is essential. Updates often include important security patches and new features. Follow these steps to ensure your QuickBooks is always up-to-date:

- Open QuickBooks and go to the Help menu.

- Select Update QuickBooks Desktop.

- Click on the Update Now tab.

- Check the box for Reset Update to delete previous update downloads.

- Click Get Updates to start the download.

- Restart QuickBooks once the download is complete.

Best Practices

Following best practices ensures your QuickBooks remains efficient. Here are some tips:

- Regular Backups: Backup your data weekly to avoid data loss.

- Reconcile Accounts: Reconcile your accounts monthly to ensure accuracy.

- Use Class Tracking: Use class tracking to categorize expenses and income.

- Review Reports: Review financial reports regularly to monitor business health.

Implement these tips to keep QuickBooks running smoothly. Regular maintenance ensures efficient financial tracking for your business.

Credit: quickbooks.intuit.com

Frequently Asked Questions

How Do I Install Quickbooks For My Business?

Download QuickBooks from the official site, run the installer, and follow on-screen instructions.

What Are The System Requirements For Quickbooks?

QuickBooks needs Windows 10 or later, 4GB RAM, and 2. 5GB free disk space.

How Do I Create A New Company File?

Open QuickBooks, click on “Create a new company,” and follow the setup wizard.

Can I Import Data From Excel To Quickbooks?

Yes, use the import feature under the “File” menu to import data from Excel.

How Do I Set Up My Chart Of Accounts?

Navigate to “Lists,” select “Chart of Accounts,” and add accounts based on your business needs.

How Do I Connect My Bank Account To Quickbooks?

Go to “Banking,” select “Add Account,” and follow the prompts to connect your bank account.

How Do I Create Invoices In Quickbooks?

Click on “Create Invoices” under the “Customers” menu, fill out the required fields, and save.

How Do I Track Expenses In Quickbooks?

Enter expenses under the “Vendors” menu by selecting “Enter Bills” or “Write Checks. “

Can I Set Up Payroll In Quickbooks?

Yes, go to the “Employees” menu, select “Payroll Setup,” and follow the on-screen instructions.

How Do I Generate Financial Reports?

Navigate to the “Reports” menu, choose the desired report, customize it, and click “Run Report. “

Conclusion

Setting up QuickBooks for your small business is simple and beneficial. It helps manage finances efficiently. Follow the steps outlined for a smooth setup process. QuickBooks will streamline your accounting tasks. Enjoy the ease and accuracy it offers. Start today and see the difference it makes.